About

Mission

To bridge the infrastructure finance gap, and democratize access to quality of life services through digital innovations in data-driven business models and systems design, by delivering innovative educational programs, research and public/private partner projects.

Vision

Our vision is to develop and test financial models to accelerate investment, design and scalability of smart, resilient, and sustainable infrastructures:

- Data (fusion) platforms to price ESG risk for sustainable indexing strategies

- Debt securitization of loans against smart asset performance data

- Fractionalization and tokenization of real asset valuation with blockchain infrastructure

- Business-to-Business (B2B) market solutions using data sales and auctions models

- Application of web scraping, natural language processing and machine learning tools

- Engineering modeling support for design of sustainability-linked bonds and loans

- Actuarial modeling and testing of risk transfer models (swaps, options, insurance)

- Data and financial network mapping for supply chain risk analysis and data market adoption strategies

Our Value Proposition

-

Data Science

Machine learning, A.I. & natural language processing (NLP)

-

Financial Technology

Tokenization, blockchain, algorithmic decision-making

-

Risk Assessment, Allocation & Transfer

Privacy, cybersecurity, price volatility

-

Sustainable Infrastructure

Metrics, designs, evaluation, scenarios

-

Efficient Financing Models

Risk & return, asset classes, policy, legal

-

Risk Management

Advanced analytics, decision models, visualization

-

Internships

For credit agreements with financial services/fintech/asset management

-

Licensing

Intellectual property transfer and (co)-development of software tools

-

Problem Solving

Corporate/startup memberships; InfraTech hackathons; Empirical research

Public investment in infrastructure systems in the U.S. is shifting towards meeting the demand for high performing, high-capacity and resilient systems.

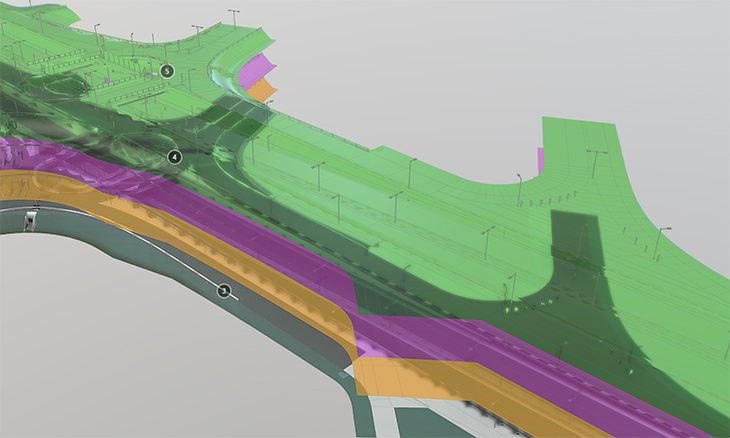

To deliver on our mission of serving the public good, we need alternative financing mechanisms. Intelligent infrastructure, data analytics based on information derived from infrastructure, and the integration of performance data with financing mechanisms offer new opportunities. See link below for an immersive 3D experience.

Future infrastructure will be connected and automated through sensors and computational approaches that help us better understand the performance of these smart systems. Roads and bridges, water and energy systems, buildings and industrial operations—all are being designed to become more adaptive, responsive and resilient. The data generated in this information-driven approach can bring in new investors, attracted by the information efficiencies and value of the infrastructure and the premiums they can get if the infrastructure exceeds performance targets.

These ideas are percolating in the finance world and require an understanding of operational performance of infrastructure. Civil and environmental engineers have a wealth of expertise to bring to the table. Our deep domain knowledge in designing smart infrastructure systems that are in harmony with natural environments, our capacity to harness data and distill information through engineering models, combined with our direct involvement with the potential applications and needs facing communities across the globe, is central to the digital revolution of smart systems. By helping to develop standards and benchmarks, civil and environmental engineers will enable the responsible and equitable integration of smart infrastructure design with efficient financing models in service to society.

Professor CEE

Professor and Department Chair CEE

Professor

Professor

Professor

Professor of Practice

Professor And John L. Tishman Cm Faculty Scholar CEE

Professor, Co-director, Center for Risk Analysis Informed Decision Engineering